Top 10 Most Reliable Chart Patterns for 2025

Introduction

Chart patterns continue to be one of the most effective tools in a trader’s toolkit. While not all patterns work equally well, some have consistently shown a high probability of success. In this guide, we reveal the 10 most reliable chart patterns for 2025 that traders can use across the stock, futures, forex, and crypto markets.

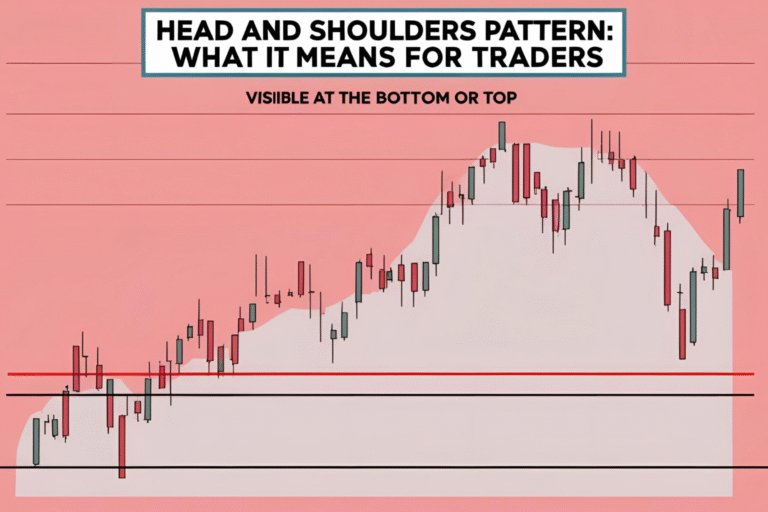

1. Head and Shoulders

Type: Reversal Pattern

Reliability: High

The head and shoulders pattern signals a strong reversal after a bullish trend. It’s considered one of the most dependable patterns in technical analysis.

Best Used In: Daily or 4H charts (stocks, forex, crypto)

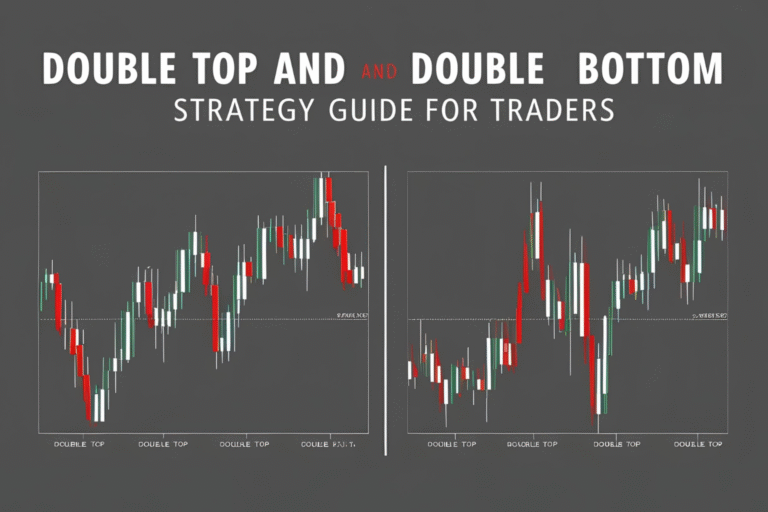

2. Double Top and Double Bottom

Type: Reversal Pattern

Reliability: High

These patterns highlight price rejection at key levels and are often followed by sharp reversals.

Tip: Look for confirmation with volume spikes.

3. Cup and Handle

Type: Continuation Pattern

Reliability: High

A bullish pattern showing a period of consolidation followed by a breakout.

Ideal For: Swing traders in stock and crypto markets.

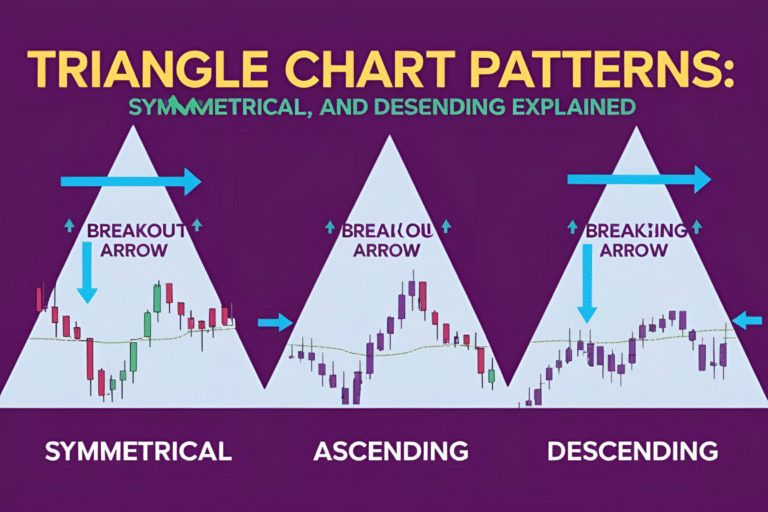

4. Ascending Triangle

Type: Continuation Pattern

Reliability: Very High in Uptrends

Signals a bullish breakout when the price consistently tests resistance.

Confirmation: Break above the horizontal resistance line.

5. Descending Triangle

Type: Continuation Pattern

Reliability: High in Downtrends

Suggests bearish continuation after a breakdown from support.

Market Suitability: Crypto and forex pairs during downtrends.

6. Symmetrical Triangle

Type: Neutral / Continuation Pattern

Reliability: Moderate to High

Can break either way. Best used with volume and breakout confirmation.

Timeframes: Works well across 1H and 4H charts.

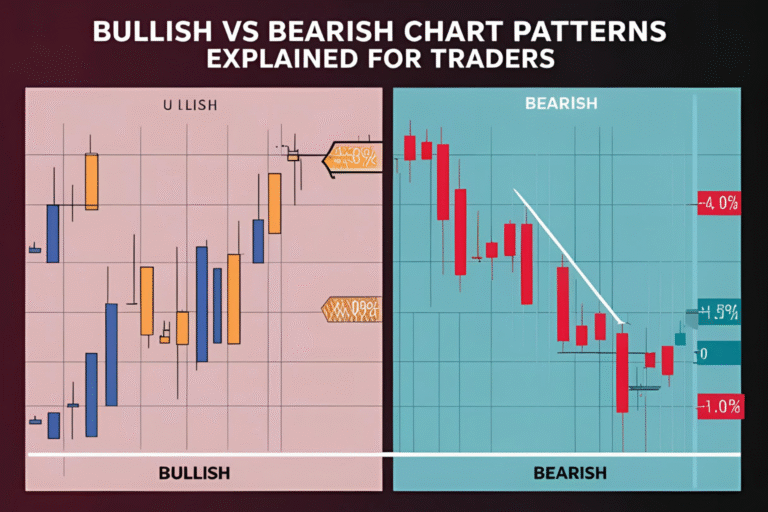

7. Bull Flag

Type: Continuation Pattern

Reliability: High

Appears after a strong uptrend and signals trend continuation.

Trick: Look for a brief consolidation before the breakout resumes.

8. Bear Flag

Type: Continuation Pattern

Reliability: High

Similar to a bull flag but follows a sharp downtrend.

Application: Great for short-selling strategies in futures and crypto.

9. Wedge Patterns (Rising/Falling)

Type: Reversal or Continuation

Reliability: Moderate to High

The falling wedge is generally bullish, while the rising wedge is bearish.

Watch For: Breakouts with volume confirmation.

10. Inverse Head and Shoulders

Type: Reversal Pattern

Reliability: High

An upside-down version of the head and shoulders—signals a trend reversal from bearish to bullish.

Best Used In: Daily timeframes for long setups.

How to Trade Reliable Chart Patterns

- Confirm with Volume: Strong breakouts usually come with high volume.

- Use Stop Losses: Set stops below/above pattern invalidation zones.

- Combine with Indicators: Use RSI, MACD, or EMAs for additional confirmation.

- Practice Pattern Recognition: Use demo platforms to gain confidence.

- Stay Disciplined: Not all patterns work 100%—focus on probabilities.

FAQs

Which chart pattern is most reliable for swing trading?

The cup and handle and head and shoulders are highly reliable for swing trades.

Are chart patterns effective in forex trading?

Yes, especially triangle and wedge patterns in 1H and 4H timeframes.

Do these patterns work for crypto markets?

Absolutely. Many crypto price moves follow classic patterns due to retail-driven behavior.

Should I rely solely on chart patterns?

No. Always use a combination of price action, indicators, and risk management.

Which is better: continuation or reversal patterns?

Both are valuable. Continuation patterns help ride trends; reversal patterns help spot turning points.