How to Trade Flag and Pennant Patterns: Complete Strategy Guide

Introduction

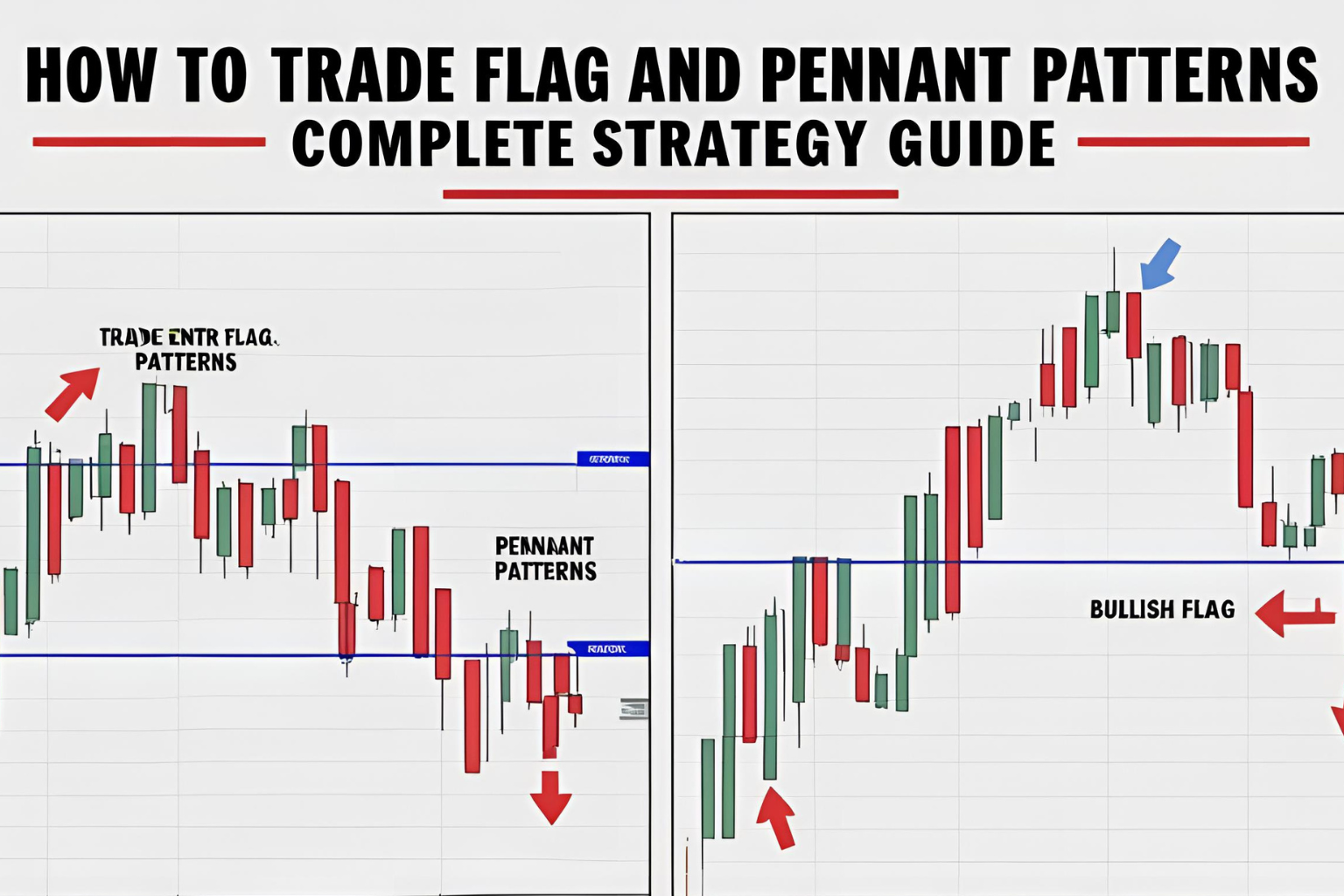

Flag and pennant chart patterns are powerful continuation setups that offer traders high-probability entries in trending markets. Known for their speed and clarity, these patterns frequently appear in stocks, forex, futures, and crypto—especially during strong momentum phases. This guide covers how to spot, confirm, and trade flag and pennant patterns like a pro.

What Are Flag and Pennant Patterns?

These are short-term continuation patterns that form after a sharp price movement (the “flagpole”). They represent a brief consolidation before the trend resumes.

🔹 Flag Pattern

- Structure: Small rectangular pullback against the trend

- Types: Bull Flag (uptrend), Bear Flag (downtrend)

🔹 Pennant Pattern

- Structure: Converging trendlines forming a small symmetrical triangle

- Types: Bull Pennant, Bear Pennant

Key Similarity: Both follow a strong directional move and signal continuation once the breakout occurs.

Pattern Structure Overview

| Component | Description |

|---|---|

| Flagpole | Sharp initial move with strong volume |

| Flag/Pennant | Brief pause or consolidation |

| Breakout | Continuation in the direction of the pole |

Entry, Stop Loss, and Profit Targets

| Strategy Element | Rule |

|---|---|

| Entry | On breakout of flag/pennant with volume confirmation |

| Stop Loss | Below flag support (bullish) or above resistance (bearish) |

| Target | Height of flagpole projected from breakout point |

Best Timeframes and Markets

- Stocks: 15M, 1H, 4H (especially on earnings breakouts)

- Crypto: 1H and 4H charts during volatile periods (e.g., BTC, ETH)

- Forex: 1H or 4H on high-momentum pairs (e.g., GBP/JPY, EUR/USD)

- Futures: Ideal for intraday trading in ES, NQ, CL

Example: Bull Flag in Tesla (TSLA)

- Initial Move: $700 to $750

- Flag: Pullback to $735

- Breakout Entry: Above $750

- Target: $800 (50-point pole projected from $750)

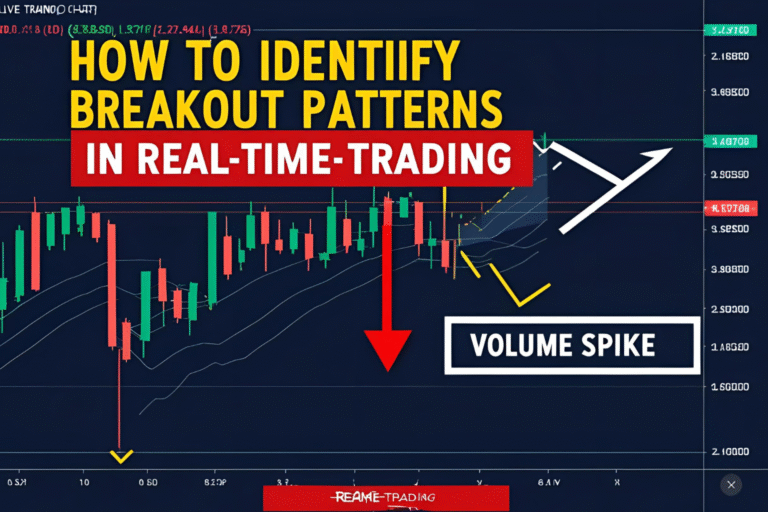

Confirmation Tools

- Volume Spike on Breakout

- MACD Crossover in Trend Direction

- RSI Above 50 (bullish) or Below 50 (bearish)

Tips for Trading Flag and Pennant Patterns

- Wait for a clear breakout before entering.

- Avoid trading inside the consolidation zone.

- Use tight stop-loss to manage risk efficiently.

- Focus on setups with strong trend momentum.

FAQs

Are flag and pennant patterns reliable?

Yes. They are among the most reliable continuation setups when confirmed by volume.

What’s the difference between a flag and a pennant?

Flags have parallel trendlines; pennants have converging trendlines.

Can I trade these patterns on small timeframes?

Yes, but confirm with volume and use tighter stops due to increased noise.

Do these patterns work for crypto?

Absolutely. Bull and bear flags are common on coins like BTC and SOL.

How long do flag and pennant patterns last?

Typically a few candles to several sessions, depending on the timeframe