Chart Patterns with High Win Rate: Backtest Results for Traders

Introduction

Not all chart patterns are created equal. Some consistently perform better than others, offering traders higher probabilities of success. In this post, we’ll share backtested results on chart patterns with high win rates, so you can focus your strategy on the most reliable setups in the market—whether you’re trading stocks, forex, futures, or crypto.

What Is a High Win Rate Pattern?

A high win rate pattern is one that historically leads to successful trades more than 60% of the time when traded under standard rules (confirmed breakout, risk management, proper entry/exit).

Note: A high win rate does not mean guaranteed success—it simply increases your edge when combined with discipline and confirmation.

Backtested High Win Rate Chart Patterns

1. Double Bottom

- Win Rate: ~70% (bullish reversal)

- Works Well In: Stocks and crypto

- Entry: After neckline breakout

2. Cup and Handle

- Win Rate: ~68%

- Strength: Bullish continuation after consolidation

- Confirmation: Volume spike on breakout

3. Head and Shoulders (Inverse)

- Win Rate: ~65%

- Use Case: Trend reversal in downtrends

- Effective In: Forex and futures on 4H or Daily

4. Bull Flag

- Win Rate: ~64%

- Strength: Momentum continuation setup

- Used In: Intraday futures and forex trades

5. Ascending Triangle

- Win Rate: ~62%

- Behavior: Price tests resistance repeatedly before breakout

- Ideal For: Swing trades in trending stocks

Performance Summary Table

| Pattern | Win Rate (%) | Type | Best Markets |

|---|---|---|---|

| Double Bottom | 70% | Reversal | Stocks, Crypto |

| Cup & Handle | 68% | Continuation | Stocks, Crypto |

| Inverse H&S | 65% | Reversal | Forex, Futures |

| Bull Flag | 64% | Continuation | Forex, Futures |

| Ascending Triangle | 62% | Continuation | Stocks, Crypto |

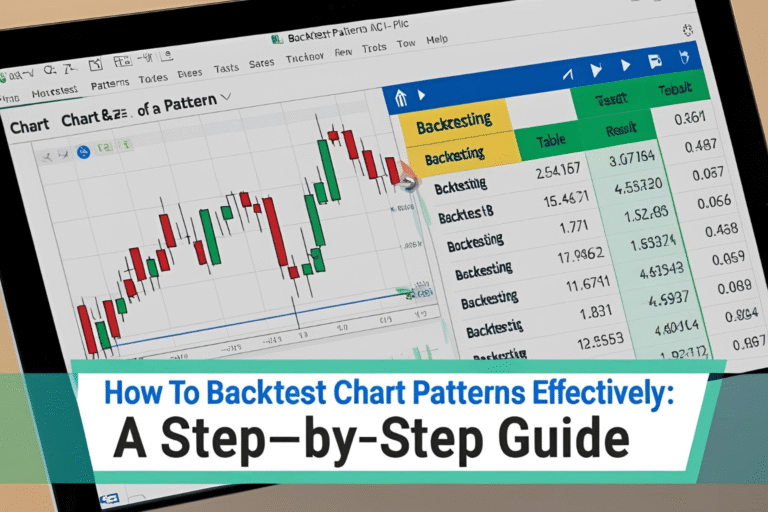

Backtesting Conditions (For Reference)

- Timeframes Tested: 1H, 4H, Daily

- Markets: S&P 500 stocks, EUR/USD, BTC/USD, Crude Oil Futures

- Tools Used: TradingView Bar Replay, pattern scanner tools

- Confirmation Requirements: Breakout candle close + volume + target vs stop ratio ≥ 1.5:1

Important Notes for Traders

- Always use volume and indicator confirmation.

- These win rates are based on clean setups—avoid noisy charts.

- Apply consistent entry/exit rules.

- Use a stop loss to protect against failed breakouts.

How to Use This Data in Your Trading

- Focus your pattern study and trades on high-probability setups.

- Backtest these patterns on your own preferred assets.

- Use trading journals to track your personal success rate.

FAQs

Which chart pattern has the highest win rate?

Based on backtests, the double bottom has shown the highest success rate when traded with confirmation.

Do win rates vary by market?

Yes. Crypto tends to have more false breakouts, while stock and forex patterns may behave more consistently.

Can I trust pattern win rates from backtests?

They offer strong guidance, but live trading includes variables like news, slippage, and emotional bias.

What increases the success of chart patterns?

Combining patterns with indicators like RSI or MACD and waiting for strong breakout volume.

Is it better to trade fewer but higher-probability patterns?

Yes. Quality over quantity leads to more consistent results in technical trading.