Common Mistakes Traders Make with Chart Patterns

Introduction

Chart patterns can be powerful tools for predicting price movements—if used correctly. However, many traders fall into the trap of misidentifying setups, rushing entries, or ignoring confirmations. In this guide, we’ll highlight the most common chart pattern trading mistakes and how to avoid them so you can increase your success rate in stocks, crypto, forex, and futures.

1. Trading Before the Breakout

One of the biggest mistakes is entering a trade before the pattern confirms with a breakout.

Why It’s a Problem:

The pattern might fail or turn into something else entirely.

Fix It:

Wait for a full candle close beyond resistance or support, and confirm with volume.

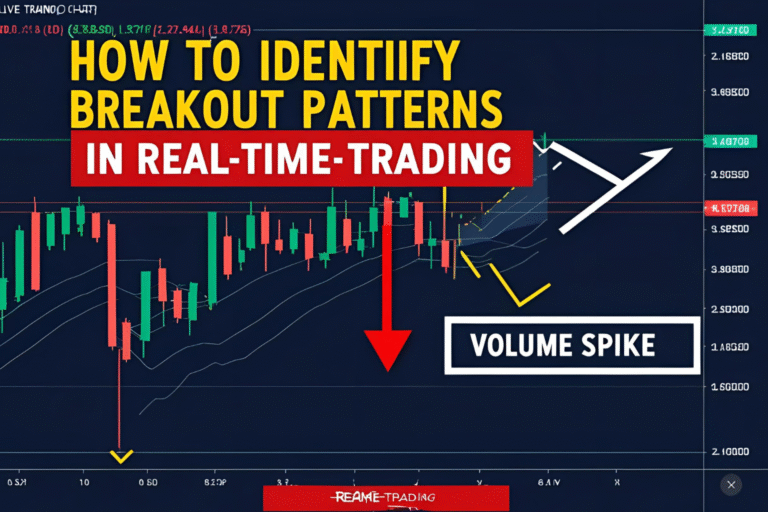

2. Ignoring Volume Confirmation

Volume is a critical component of breakout success. Ignoring it leads to false signals.

Mistake:

Entering a trade without noticing low or declining volume.

Solution:

Look for increased volume on the breakout to confirm strength.

3. Misidentifying Patterns

Many traders force patterns where none exist.

Mistake:

Labeling random price moves as valid patterns.

Solution:

Use clean charts and wait for textbook structures (e.g., double bottoms, flags, triangles).

4. Using Patterns on Noisy Timeframes

Very small timeframes like 1-minute or 5-minute charts often create noise, not reliable signals.

Mistake:

Overtrading poor-quality setups.

Solution:

Use higher timeframes like 1H, 4H, or Daily for more accurate patterns.

5. No Stop-Loss Placement

Assuming the pattern guarantees success is a dangerous mindset.

Mistake:

Not placing stop-loss orders or using overly wide ones.

Solution:

Place stops just outside the pattern boundary (e.g., below the handle in cup and handle).

6. Not Considering Market Context

A great pattern in a weak market can still fail.

Mistake:

Trading against overall market trend or during low-volume sessions.

Solution:

Check the trend and trading session before taking a pattern trade.

7. Overloading with Indicators

Too many indicators can lead to analysis paralysis.

Mistake:

Crowding the chart with conflicting signals.

Solution:

Use 1–2 confirmation indicators like RSI or MACD, alongside price action.

8. No Trade Plan or Risk Management

Mistake:

Blindly trading patterns without a plan for entry, stop, and target.

Solution:

Use a risk-reward ratio of at least 1.5:1 and predefine your position size.

Quick Checklist for Smart Pattern Trading

✅ Wait for breakout confirmation

✅ Confirm with volume or an indicator

✅ Use proper stop-loss placement

✅ Trade in line with the broader trend

✅ Avoid small/noisy timeframes

✅ Stick to high-probability, clean setups

FAQs

Do chart patterns work all the time?

No. They are probabilistic tools, not guarantees. Proper confirmation and risk control are essential.

How do I know if a pattern is valid?

It should have symmetry, structure, volume behavior, and ideally align with the trend.

Should I only use patterns to trade?

Patterns work best when combined with indicators, support/resistance, and price action.

What if the pattern fails?

Take the loss and move on. Use a stop-loss to minimize damage.

Can beginners avoid these mistakes easily?

Yes—with education, discipline, and a commitment to sticking with tested rules.