Chart Pattern Recognition Software: Best Tools for Traders

Introduction

Manually spotting chart patterns can be time-consuming, especially when tracking multiple assets. That’s where chart pattern recognition tools come in—they automatically scan charts, identify setups, and help traders act faster. This post highlights the best software and platforms for chart pattern recognition in stocks, forex, crypto, and futures.

Why Use Chart Pattern Recognition Tools?

- Save Time: Scan hundreds of charts in seconds

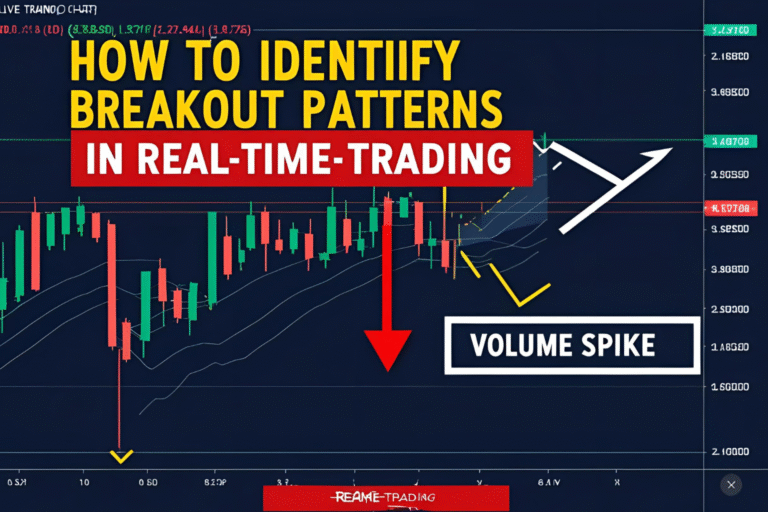

- Catch Early Setups: Get alerts before breakouts happen

- Improve Accuracy: Avoid human bias and pattern misidentification

- Multi-Market Utility: Works across stocks, forex, crypto, and commodities

Top Chart Pattern Recognition Tools

1. TradingView

- Features: Built-in pattern drawing tools and indicator-based scanners

- Strength: Visual clarity, customizable alerts

- Markets Covered: Stocks, crypto, forex, indices

- Bonus: Community-created scripts for custom pattern detection

2. TrendSpider

- Features: AI-based pattern recognition, auto trendline drawing

- Strength: Real-time auto analysis, multi-factor alerts

- Ideal For: Active traders and swing traders

- Includes: Backtesting and heatmaps

3. MetaTrader 4/5 + Plugins

- Tools: Autochartist plugin or Pattern Recognition Indicator

- Strength: Widely used in forex trading

- Customizable: Use with Expert Advisors for automated trades

4. Finviz (Elite)

- Features: Stock screener with technical patterns filter

- Use Case: Quickly find stocks forming triangles, wedges, etc.

- Note: Best suited for U.S. equity traders

5. ChartMill

- Tools: Pattern-based stock scanner

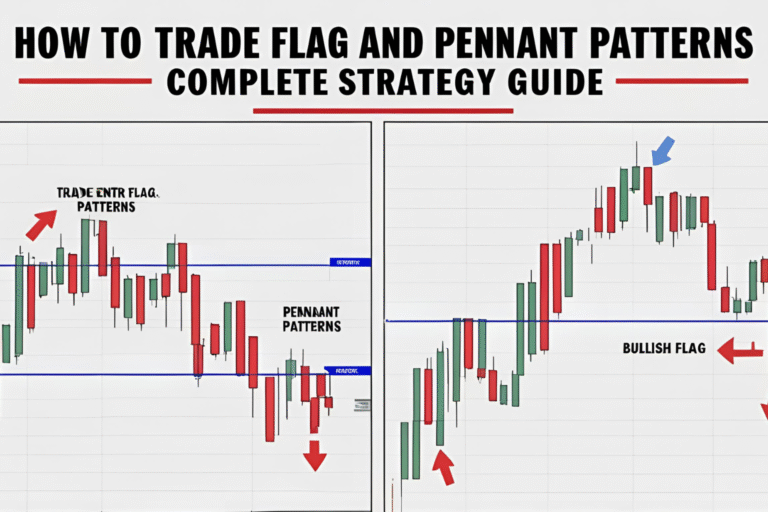

- Strength: Flags, pennants, double tops/bottoms

- Interface: User-friendly; browser-based platform

6. Autochartist

- Features: Automated pattern detection + market reports

- Markets: Forex, stocks, commodities

- Integration: Works with many brokers like IG, OANDA, Forex.com

What to Look for in Pattern Software

| Feature | Why It Matters |

|---|---|

| Real-time alerts | Helps react quickly to emerging breakouts |

| Custom settings | Tailor alerts by pattern type or asset class |

| Multi-timeframe support | Patterns may form on 1H, 4H, or daily |

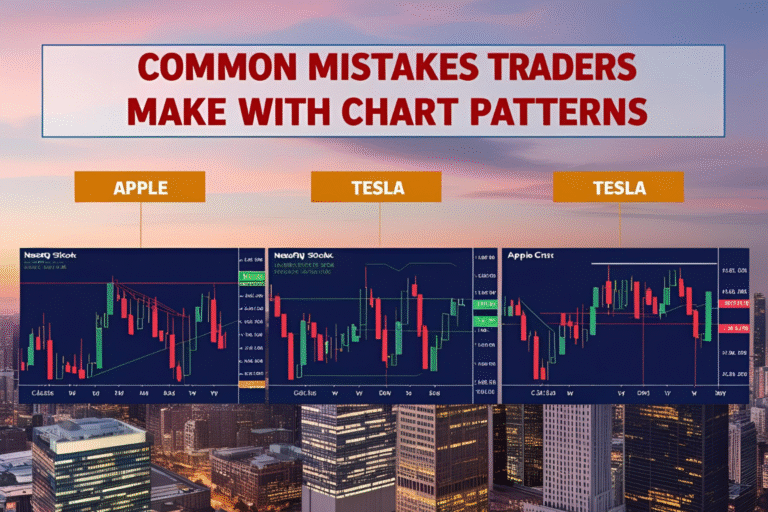

| Accuracy & reliability | Avoid tools with too many false signals |

How to Use Recognition Tools Effectively

- Set filters for your preferred patterns (e.g., bull flags, triangles)

- Get alerts via email or mobile app

- Check volume and price action before entering trades

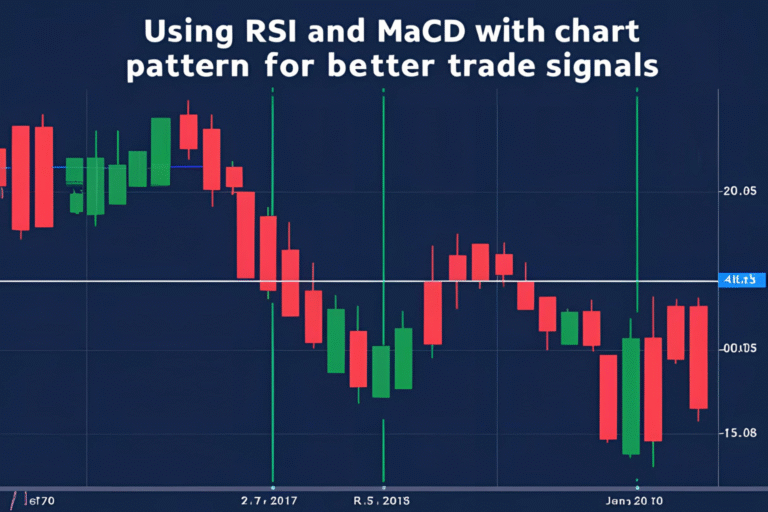

- Combine with RSI, MACD for confirmation

- Backtest patterns on your asset class

FAQs

Is chart pattern recognition software accurate?

Most tools are highly accurate when used with confirmation signals and proper filters.

Do these tools work for crypto?

Yes. Platforms like TradingView and Autochartist support crypto pattern scanning.

Are free tools as good as paid ones?

Free tools like TradingView are great for visual scanning. Paid tools often offer real-time alerts and automation features.

What’s the best software for forex pattern recognition?

MetaTrader with Autochartist or TradingView with forex-specific scripts.

Can these tools replace manual analysis?

They complement manual analysis by speeding up the process and improving pattern detection, but human judgment is still important.