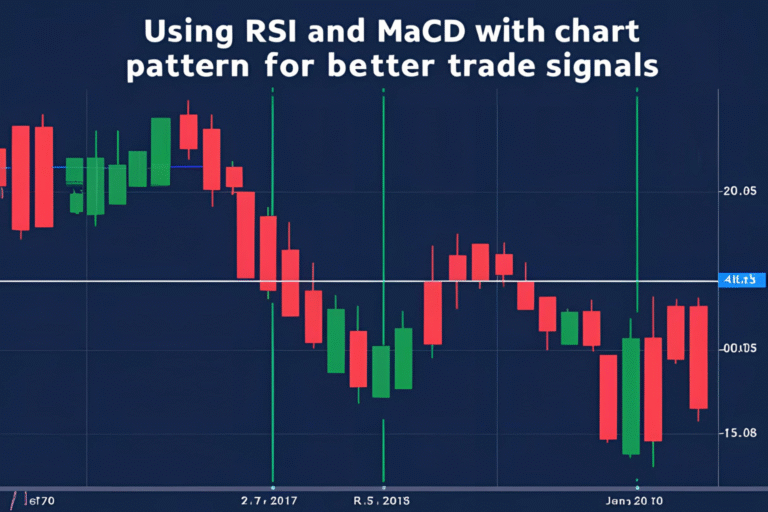

Combining MACD and Stochastic for Better Trade Signals

IntroductionMACD and Stochastic Oscillator are two of the most widely used momentum indicators in technical analysis. When combined with chart patterns, they can help filter out weak setups and provide clearer entry and exit signals. In this post, you’ll learn how combining MACD and Stochastic enhances your pattern-based trading strategy across stocks, forex, crypto, and…