Triangle Chart Patterns: Symmetrical, Ascending, and Descending Explained

Introduction

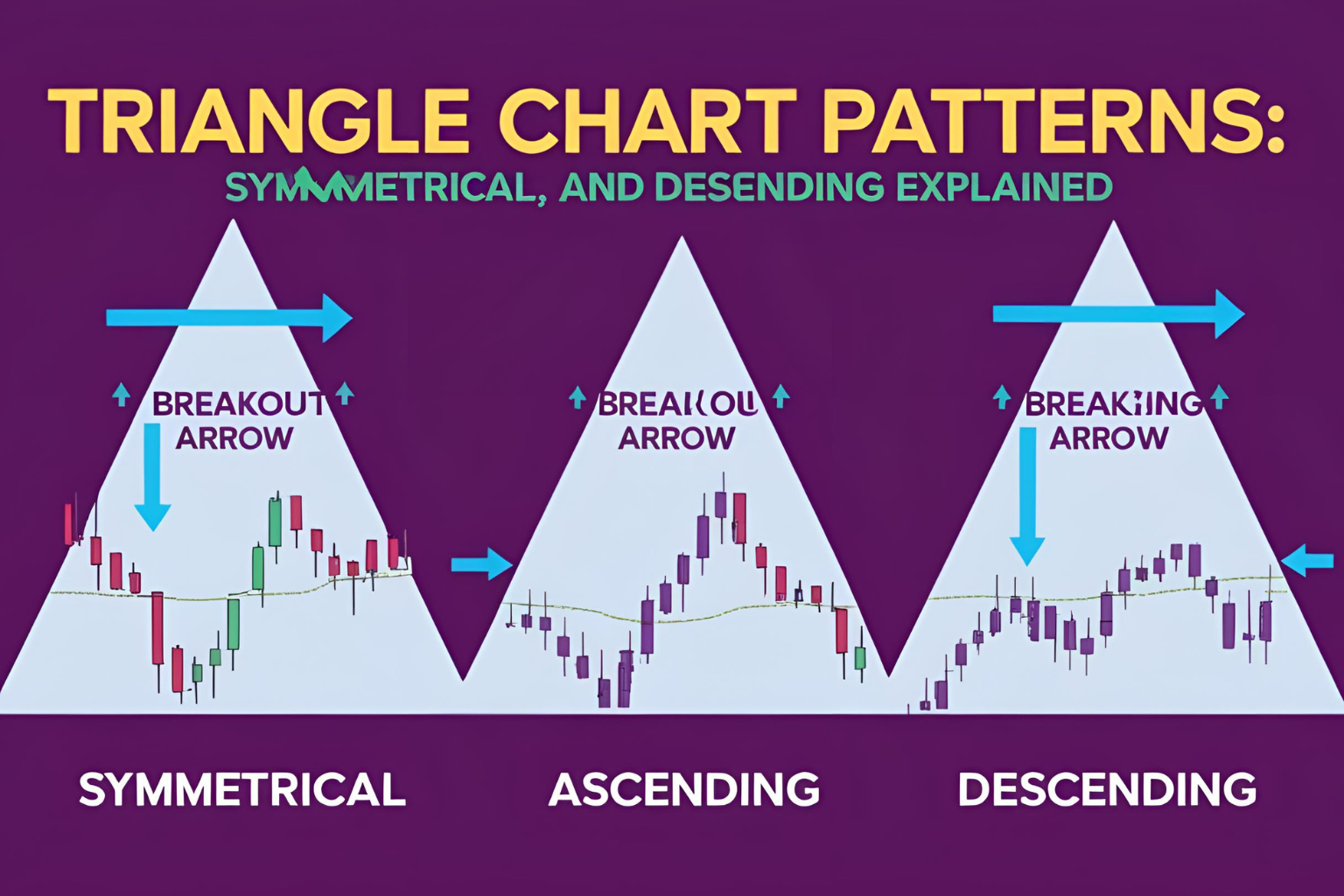

Triangle chart patterns are among the most frequently observed and traded formations in technical analysis. These patterns signal periods of consolidation that typically end in breakouts. In this guide, we’ll break down the three primary types of triangle chart patterns—symmetrical, ascending, and descending—and show you how to trade each one effectively across stocks, forex, crypto, and futures.

What Are Triangle Chart Patterns?

Triangle patterns form when price action contracts into a narrowing range, bounded by trendlines. They typically indicate a potential breakout, with the direction depending on the type of triangle and the trend leading into it.

1. Symmetrical Triangle

Structure:

- Converging trendlines (lower highs and higher lows)

- No clear bias until breakout

Signal:

Neutral until breakout occurs

- Bullish breakout: Continuation of uptrend

- Bearish breakout: Reversal or continuation of downtrend

Best Used In:

Trending markets (stock, forex, crypto)

Entry Strategy:

Enter after a confirmed breakout with strong volume.

2. Ascending Triangle

Structure:

- Flat resistance on top

- Rising support line from below

Signal:

Bullish continuation pattern

Common In:

Uptrends where buyers repeatedly test resistance

Entry Strategy:

Buy on breakout above horizontal resistance with volume confirmation.

3. Descending Triangle

Structure:

- Flat support at the bottom

- Descending resistance from above

Signal:

Bearish continuation pattern

Seen In:

Downtrends, especially in crypto or forex pairs

Entry Strategy:

Sell short after breakdown below support with increasing volume.

Triangle Patterns vs. Wedges

| Feature | Triangle | Wedge |

|---|---|---|

| Trendlines | Converging | Sloping in same direction |

| Volume | Declines before breakout | Declines and then expands |

| Signal | Depends on breakout | Often suggests reversal |

Timeframes and Markets

- Stocks: Daily and 4H charts (e.g., SPY, AAPL)

- Crypto: 1H and 4H (BTC, ETH often form symmetrical triangles)

- Forex: Great for EUR/USD, USD/JPY on 1H, 4H, and Daily

- Futures: Triangle setups appear frequently in ES, NQ, CL

Example: Ascending Triangle on ETH/USDT

- Flat resistance: $2,500

- Rising support: Higher lows from $2,200

- Breakout: Above $2,500 on volume

- Target: Height of triangle added to breakout level

Confirmation Tools

- Volume Spike: Confirms breakout strength

- RSI Divergence: Adds reliability

- MACD Crossover: Helps time entries

FAQs

Which triangle pattern is most bullish?

The ascending triangle is considered most bullish due to repeated pressure on resistance.

Can symmetrical triangles break either way?

Yes. Wait for confirmation before trading.

How do I set a stop loss?

Below the lower trendline for bullish breakouts; above the upper line for bearish ones.

Are triangle patterns reliable in crypto trading?

Yes. They often precede major breakout moves in volatile coins.

Can triangle patterns appear on intraday charts?

Yes, especially 15m and 1H charts in futures and forex trading.